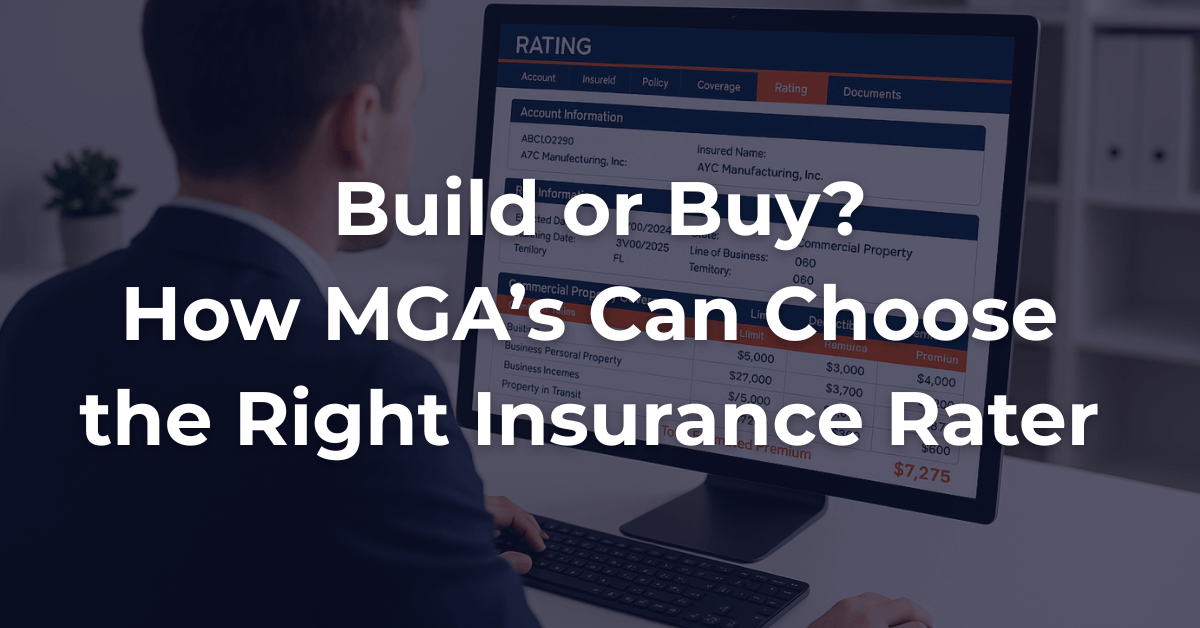

Navigating the Build vs. Buy Decision

Running an MGA means making smart choices about your tools every day. And when it comes to insurance rating software, this choice can make or break how smoothly your business runs.

We’ve talked to dozens of MGAs who’ve hit this crossroad. Your current rater worked great when you started, but now you’re wondering if it’s time for something different.

Sound familiar? You’re not alone.

The Real Question Every MGA Faces

We hear this all the time: “Should we stick with the off-the-shelf software or build our own custom rater?”

It’s a big decision. Your rating system touches everything, from how fast you can get quotes to brokers to how happy your underwriters are at the end of the day.

At Vital Services, we’ve helped MGAs work through this exact question. And here’s what we’ve learned: no magic answer works for everyone. But there are smart ways to figure out what’s right for your business.

Let’s Talk About Off-the-Shelf Solutions

Most MGAs start with ready-made rating tools. These systems are like buying a car off the lot; they come with everything you need to get moving right away.

These tools work well for many MGAs, especially those with standard product lines or small businesses. They’re quick to set up, and your team probably already knows how to use similar systems.

But here’s what happens as you grow: you start bumping into walls.

Maybe you’re waiting weeks for simple rate updates. Maybe your business has grown and you need a rater that can scale with your business. Maybe the long-time costs are becoming too much for your budget.

These aren’t necessarily bad systems, they just weren’t built for how your MGA works.

When Building Custom Makes Sense

Some MGAs reach a point where they need something built just for them. It’s like having a custom-built car for exactly how you drive.

We see MGAs choose custom raters when:

Your products are unique. If you’re writing specialty lines or complex coverage that doesn’t fit standard templates, custom might be your best bet.

Speed is everything. When brokers expect instant quotes and every second counts, custom systems can be lightning fast.

You want control. Tired of waiting for vendor updates? With a custom system, you set the timeline.

You’re planning to scale. If you’re growing fast or expanding into new markets, custom systems can grow with you.

The best part? A custom rater works exactly like your underwriters think. No more forcing your process into someone else’s box.

You Don’t Have to Figure This Out Alone

We get it, this decision feels overwhelming. You’re running a business, not a tech company. How are you supposed to know what’s right?

That’s where we come in. We sit down with MGAs and really understand how they work. What are your pain points? Where do you want to be in two years? What’s your team comfortable with?

Sometimes the answer is sticking with what you have and making it work better. Sometimes it’s building something completely new. Often, it’s a mix of both.

The Bottom Line

Your rating system should make your life easier, not harder. It should help your team quote faster, serve brokers better, and grow your business. Whether you build, buy, or improve what you have, the goal is the same: a system that works the way you do.

We’re here to help you get there, at your pace, with your budget, and on your terms.

Ready To Explore Your Options?

Every MGA’s situation is different, and that’s okay. What matters is finding the solution that fits your business.

Want to talk through your options? We’d love to help you figure out what’s next for your rating system. Contact our team today and let’s start the conversation about what’s possible for your MGA.